A Medigap policy, also called Medicare Supplemental Insurance, can significantly reduce your out-of-pocket healthcare costs if you’re enrolled in Original Medicare. However, it is not available for those with private Medicare Advantage plans, also known as Medicare Part C.

People purchase Medigap policies because the out-of-pocket costs for Medicare Part A’s hospital expenses and Part B’s doctor visits, outpatient care, and medical equipment can be substantial. However, Medigap does not cover Part D prescription drug expenses.

Without Medigap, if you have Original Medicare, you are responsible for a $1,600 Part A deductible in 2023, along with coinsurance of up to $400 per day for hospital stays lasting 61 to 90 days, and $800 per day for 60 “lifetime reserve days.” Additionally, you must pay the Part B monthly premium of $164.90 (higher for high-income individuals), a $226 annual deductible, and the significant burden of 20% coinsurance on Medicare-approved charges.

A Medigap policy can help cover some or many of these costs. It may even offer additional benefits that Original Medicare doesn’t provide, such as dental, vision, and hearing care.

You can typically use a Medigap policy anywhere in the U.S., making it particularly valuable for snowbirds who spend their winters in warmer climates.

For those interested, it is best to purchase the coverage when you first enroll in Medicare. This is because, during the first six months after you enroll in Part B, you have “guaranteed access” to Medigap, meaning you can’t be denied coverage due to a preexisting health condition.

If you choose to switch Medigap plans later, you might be denied coverage based on your health status.

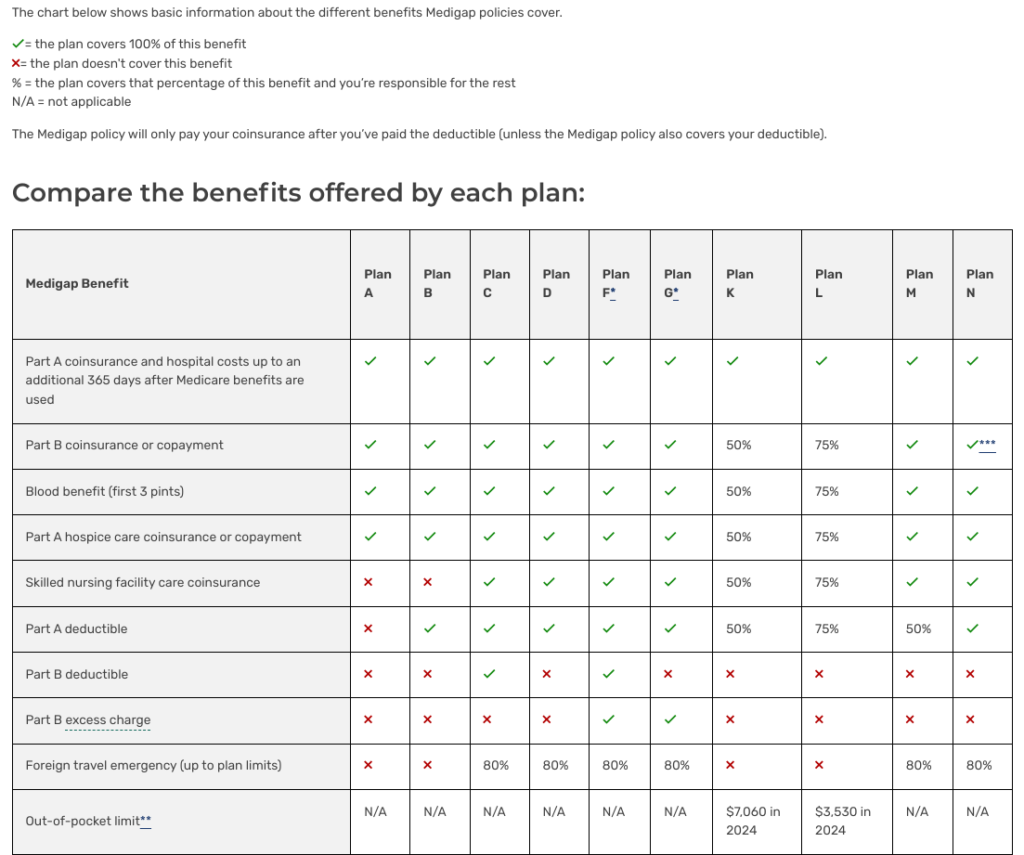

The chart below from Medicare.gov compares the benefits of each plan.

When considering a Medigap Plan

Step 1 Decide on Plan: Medigap policies are standardized and, in most states, are identified by letters ranging from Plan A to Plan N. To choose the right plan, compare the benefits each one offers and select a plan that meets your specific coverage needs

Step 2 Pick your Policy: Find policies available in your area. For plans with the same letter, the only difference between those offered by different companies is the price

Step 3 Obtain Quote: Request an official quote from the company directly or through a broker like George Alvin Insurance, as prices can vary based on factors like when you purchase, your health conditions, and other considerations. Once you’re ready to buy a policy, reach out to the company directly.