As more seniors choose to work beyond the age of 65, it’s crucial to understand the significance of creditable coverage concerning Medicare and the potential consequences of not having it.

Medicare creditable coverage refers to insurance that is considered as good as or better than Medicare, meaning it provides comparable benefits. When you have creditable coverage, you can delay enrolling in Medicare without facing a late enrollment penalty.

Most common Creditable Coverage

The most common form of creditable coverage is through a large employer group plan. A large employer is defined as one with 20 or more employees. If you’re actively working for such an employer and enrolled in their group health plan, you have creditable coverage for Medicare. This also applies if you’re on your spouse’s large employer group health plan. With this coverage, you can delay enrolling in all parts of Medicare until you lose that coverage. However, since Part A typically has a $0 premium, it’s worth considering enrolling in it as it can supplement your employer’s health plan during inpatient hospital stays. Parts B and D can be delayed until later.

However, if you have a Health Savings Account (HSA), you should avoid enrolling in Part A, as you cannot contribute to an HSA if you’re enrolled in any part of Medicare. If the HSA is in your spouse’s name, you can enroll in Part A without affecting their ability to contribute the maximum amount to the HSA.

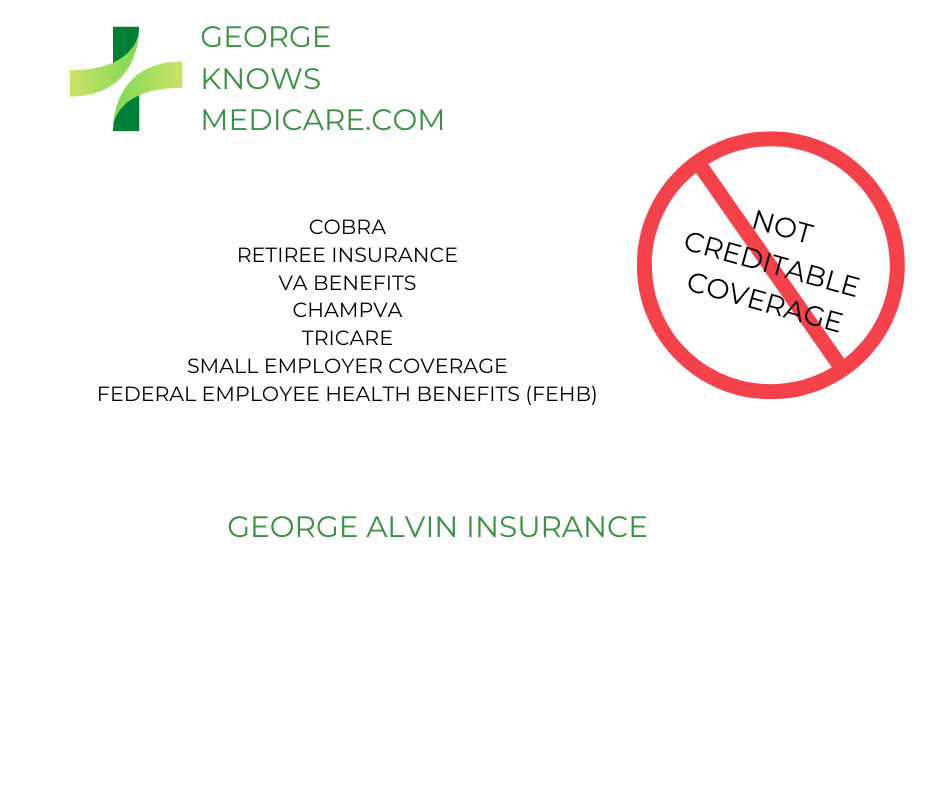

Health Insurance not considered Creditable Coverage for Medicare

Health Insurance not considered Creditable Coverage by Medicare for those working for a small employer, defined as having fewer than 20 employees, Medicare will be your primary coverage. Therefore, small employer group health plans do not count as creditable coverage for Medicare Parts A and B. However, they may still be considered creditable for Part D drug coverage. Your employer should provide a Notice of Creditable Coverage each September, indicating whether your drug coverage is creditable for Medicare. Keep this notice, as it will be needed when you eventually enroll in a Part D plan.

Similarly, VA coverage is not creditable for Parts A and B, but VA drug benefits are creditable for Part D. Even with VA medical coverage, enrolling in Parts A and B can provide additional coverage outside the VA network and help you avoid future late enrollment penalties.

If you don’t have a large employer group health plan, you likely don’t have creditable coverage for Parts A and B. This includes coverage like COBRA, retiree insurance, VA benefits, ChampVA, Tricare, and Federal Employee Health Benefits (FEHB). While some of these may be creditable for Part D, they are not for Parts A and B.

If you have COBRA or retiree insurance, you must enroll in Parts A and B within 8 months of starting COBRA or the retiree plan if you’re over 65. For Part D, if your COBRA or retiree insurance is creditable, you’ll have 63 days to enroll in a Part D plan after losing that coverage.

For ChampVA or Tricare, enrolling in Parts A and B when first eligible is essential to avoid penalties and maintain your benefits. FEHB is more complex; while it’s not creditable for Medicare, some enrollees still choose to delay Medicare. It’s important to evaluate which option is more cost-effective for you.

Penalties for not having Creditable Coverage

Source: Medicare.gov 2024

Part A: If you have to buy Part A, and you don’t buy it when you’re first eligible for Medicare, your monthly premium may go up 10%. You will have to pay the penalty for twice the number of years you did not sign up.

EXAMPLE: You were eligible for Part A for 2 years but didn’t sign up, you’ll have to pay the higher premium for 4 years. Usually, you don’t have to pay a penalty if you meet certain conditions that allow you to sign up for Part A during a Special Enrollment Period

Part B: Generally, you won’t have to pay a Part B penalty if you qualify for a Special Enrollment Period. You’ll pay an extra 10% for each year you could have signed up for Part B but did not.

EXAMPLE: If you waited 2 full years (24 months) to sign up for Part B and didn’t qualify for a Special Enrollment Period, you’ll have to pay a 20% late enrollment penalty (10% for each full 12-month period that you could have signed up), plus the standard Part B monthly premium ($174.70 in 2024).

$174.70 (2024 Part B standard premium)

+ $34.94 (20% [of $174.70] late enrollment penalty)

Part D: You will pay an extra 1% for each month (that’s 12% a year) if you don’t join Part D when you first get Medicare (without creditable alternative drug coverage) or go 63 days or more without creditable drug coverage.

EXAMPLE: If you waited 14 months after you were eligible for Medicare to join a Medicare drug plan, and you didn’t have creditable drug coverage, you’ll have to pay a 14% late enrollment penalty in addition to your monthly plan premium. The penalty comes from the “national base beneficiary premium”(34.70 in 2024). This Montly penalty is added for as long as you have Medicare drug coverage. $4.90 would be the monthly penalty in this example ($34.70 x .14% = $4.90).

In Conclusion

Delaying Medicare is simpler than it seems. First, determine which parts of Medicare you have creditable coverage for. If you do, you can skip the initial enrollment. The challenge comes when you need to enroll in Medicare. Once you lose creditable coverage, visit your local Social Security office and apply in person, bringing your Notice of Creditable Coverage to avoid any late penalties. You may need a recent notice from your employer confirming you had creditable coverage for the entire period you delayed enrollment.

Finally, remember that just because you have creditable coverage doesn’t mean it’s more cost-effective than Medicare. You might find better coverage with lower premiums through Medicare.